Insurance Market is a Singaporean FinTech start-up, or InsurTech to be more precise, founded in 2014 by former financial risk consultants to propose a new way of choosing and purchasing insurance. Traditionally in Singapore as in many other Asian countries, insurance agents have been playing a big part in selling insurance. Generally it is a hassle for the customers and yet they can not make well-informed purchasing decisions: they have to first call up insurance agents, make appointments, spend hours at the agents to choose from what the agents propose. The agents usually represent certain insurance company, so naturally, they tend to recommend the insurance plans from which they can receive the most commission. As a result only limited choices are presented to the customers.

Insurance Market tries to break such a status quo of insurance sales model by introducing digital platform that allows customers to compare insurance policies among different insurance plans and efficiently make autonomous decisions. As an insurance distribution platform, Insurance Market is regulated by the Monetary Authority of Singapore. Insurance Market currently offers seven types of personal insurance and a corporate insurance online, including a relatively new type of insurance in Singapore, such as pet insurance.

Mr. Alexis Van Dam, the head of marketing says:

“We are trying to change people’s mindset - how people buy insurance and why people buy insurance. For example, in Singapore many people live with pets like a family and once their dog gets a cancer, it’s quite expensive – but many people still don’t know there is such a thing as pet insurance. From the marketing point of view, it is also about explaining what it is to the potential customers so they perceive their need. Insurance Market is a platform that showcases what is available out there and provide right information to the customers.”

To add to that, Insurance Market also offers the comparison of various maid insurance plans, something which Japanese businesses having a full-time representation in Singapore might be interested. Again, the challenge for Insurance Market is how to identify such potential customers, reach out to them, and cultivate their need by explaining what Insurance Market can offer.

According to Mr. Van Dam, their target customers are primarily digital savvy people. Even though digital savvy, young Singaporeans tend to live with their parents so they do not have things to be insured – therefore their target customers’ age starts from around 25-30 years old, those who start to spend and own items that need to be insured. The other end of the spectrum is those who are 45 to 50 years old who have a little more time, want to know it all, and want to figure out all by themselves.

To reach out to such potential customers, Insurance Market works with media companies that write articles on them and post such at some of the popular online news sites. Insurance Market thinks that taking out insurance is closely associated with personal needs; therefore they intend to add more personal touch to their digital platform interface, for example by putting up photos of people of various ages and background, so the audience can more easily associate themselves to each type of insurance. Their digital platform also contains articles that introduce various types of insurance and offer tips on saving money on insurance premium, to educate customers and cultivate their needs.

Apart from that, one of their eye-catching marketing campaigns includes free Broken Heart Insurance for the Valentine’s Day which was available for anybody who applies for, during the pre-defined period. The “policyholders” who unfortunately became heartbroken on the Valentine’s Day could make a claim by submitting their heartbroken story or logging in to their account. What was ironic and humorous about this campaign was that the insurance “payout” was a pair of movie tickets. This was also intended to be an educational campaign for the customers to actually experience the online insurance process - how to buy insurance online and how to make a claim online.

Mr. Kum Seng Wong, Chief Financial Officer explains: “Singapore is getting more and more ready for e-platform. For example, Uber has been in Singapore since five years ago but only used among foreigners. But in the last twelve to eighteen months it started to pick up very strongly among Singaporeans. The same goes to the growing online grocery, e-commerce such as Redmart, Lazada, food delivery like Food Panda, car rentals, hotel and ticket booking, to online banking. They now check online first and do shopping.”

Among the list of the things that people may search for online, insurance may come at the end at the moment, hence still the great opportunity. According to Mr. Van Dam, their web traffic is steadily increasing and they have sales every day, which shows the strong needs and interests from potential customers.

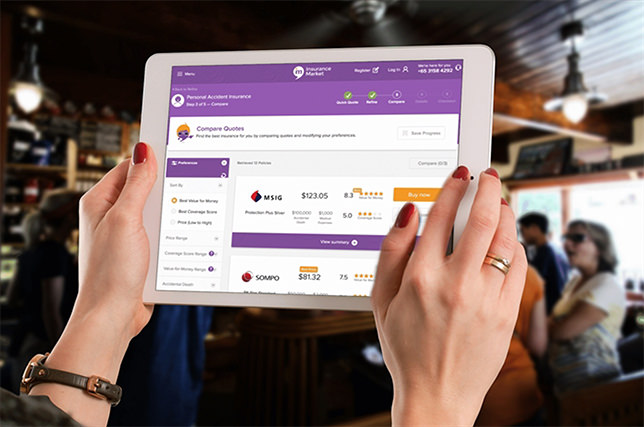

The Insurance Market’s comparison feature serves both “quick-to-go, quick-to-buy” type of customers as well as “I-want-to-know-every-detail” type of customers, Mr. Van Dam says. Their system allows the “quick-to-go” customers to pick up only what they need, whereas for those who want to consider the details of the insurance policy, they can also compare different policies head-to-head. In addition to that, their platform shows the 5-star “Value for Money” scores and “Coverage Scores” to each insurance plan in the comparison page, making it easier for customers to understand and choose. Mr. Van Dam personally thinks that customers can probably sort out and purchase what they want within fifteen to thirty minutes on their platform, while they may need two to three hours with agents.

Insurance is by nature a complex product. Mr. Wong says that life insurance, for example, is too complex and is not for their website. According to him what they can deal with on their platform is everyday insurance and more standard personal insurance, such as car insurance, travel insurance, personal accident insurance, maid insurance and so on. But this does not necessarily mean that these insurance policies are easy to understand. To make these policies more digestible and easy to understand for the customers, the Insurance Market’s platform intends to provide info-graphics and more articles on insurance.

Mr. Otbert de Jong, the CEO says,

“It is not easy to present a simple comparison of insurance policies. This is where we invest our time, and sometimes we go back to the insurance company to get clarification on the details of their policies. We also try to make the interface more intuitive to improve customer experience. Having said that, we do not want to be seen as a mere comparison site.

The Insurance Market is a distribution platform, which facilitates direct sales and intermediary sales including agents, brokers, financial advisors, and banks. These people talk to customers at the help desk, so we also get feedback from them as well, to better understand customer requirement. We are the platform where everything comes together. As such, we have a better chance of getting more holistic picture than an individual insurance company can have, and as such, we can also deliver customer’s voice.

From the marketing analytics based on the existing customers’ purchasing behavior, we intend to capture the customer requirement, or what they need to be insured. While helping the customers to perceive what they need, we also intend to tell the insurance companies what the customers need.

The insurance market is a top-down market where insurance companies design products and sell them to customers. In contrast, our approach is more customer-focused, providing independent information and leveraging on technology. We cannot change the market overnight, it will take time.”

At the moment, their web traffic shows that expats living in Singapore have more access to their website than Singaporeans living in Singapore and Singaporeans living abroad, probably because expats are more used to buying insurance online. However, Insurance Market is eyeing on the potential of further cultivating Singaporean customers in the near future against the backdrop of growing online purchase in Singapore in general.

Our Services

Rapidly providing most essential information for initial stage in business extension abroad, including local environment, business information, market information for individual industry. Industry information of the considered countries can be found here without spending hours and the need to contact multiple sources.